Everything for  Business

Business

Business

Business

Business

Business

The deal will create a pan-European competitor to Starlink Musk. The UK will retain a stake in the deal, estimated by OneWeb at more than $ 3 billion

Do you want to reduce the level in European markets? In your inbox before opening, every day. Sign up here.

British satellite firm OneWeb is moving closer to a deal to merge with France's Eutelsat Communications SA in a deal that would create a pan-European operator that could better compete with Elon Musk's Starlink project, according to people familiar with the matter.

OneWeb and Eutelsat could reach an agreement as early as next week, the people said, asking not to be named because the discussions are private. OneWeb, in which the UK government has a minority stake, will be valued at around $3 billion or more, the people said.

Paris-registered Eutelsat with a market value of about 2.4 billion euros ($2.5 billion) is backed by French state-owned investment firm BPIFrance SA and is also a minority investor in OneWeb.

As part of the proposed deal, existing investors in OneWeb would continue to hold minority stakes, the people said. These investors include the UK government and Bharti Airtel Ltd., run by telecommunications tycoon Sunil Mittal.

The combined company will be listed on the Euronext exchange in Paris, though the firm could also seek a listing in London in the future, the people said.

While discussions are progressing, no final agreement has been reached and negotiations could still end without it, the people said.

A spokesperson for OneWeb and a spokesman for the UK government declined to comment. A Spokesperson for Eutelsat was not immediately available for comment outside of business hours in France.

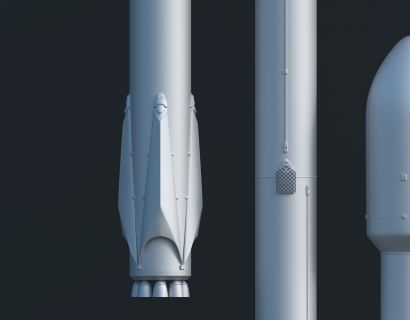

Musk's Starlink fleet of more than 1,500 satellites launched over the past three years by SpaceX has created an unprecedented challenge for competitors, leading to a wave of consolidation in the sector.

Last year, Viasat Inc. agreed to acquire Inmarsat Group Holdings Ltd. for $4 billion, creating the world's largest geostationary satellite company. Eutelsat itself rejected a takeover offer from billionaire Patrick Drahi, which valued it at 2.8 billion euros.

OneWeb emerged from bankruptcy in 2020 as part of a UK bailout with mittal, signalling the government's more interventionist industrial strategy after Brexit. A deal with Eutelsat would be a rare example of a merger between a British and a French company, and one involving two state-backed companies shows how involved the two countries' governments are in the telecommunications industry.

The company was created in 2012 to create a constellation of small satellites in low Earth orbit emitting Internet connections to isolated locations. OneWeb raised $3.4 billion from SoftBank Group Corp., Airbus SE and other big names before crashing as top investors pulled their money in the midst of the coronavirus pandemic.

What are you doing with your RV in the offseason?

What are you doing with your RV in the offseason?

Adobe will buy online design startup Figma for $ 20 billion

Adobe will buy online design startup Figma for $ 20 billion

To combat the gas crisis, Germany offers a new plan for cheap transit

To combat the gas crisis, Germany offers a new plan for cheap transit

Porsche family seeks iPO buyout after tearful defeat

Porsche family seeks iPO buyout after tearful defeat

Clubs and bars are popping up all over Manhattan, providing an alternative social hub and jobs.

Clubs and bars are popping up all over Manhattan, providing an alternative social hub and jobs.

This site uses cookies and other visitor identifiers for the convenience of each user. If you stay on our site after reading this message, it means that you have no objection to the use of these technologies. Learn more